Application hosting is the process of storing and running software applications on a remote server or data center, allowing users to access the application over the internet. It involves providing the necessary infrastructure, such as servers, storage, and networking, to ensure the application functions properly and is accessible to users from anywhere. Application hosting can be used for web applications, mobile apps, or enterprise software, and it often includes management, maintenance, security, and support services to ensure optimal performance.

Bookkeeping is the process of recording, organizing, and maintaining a company’s financial transactions systematically. It involves tracking all financial activities such as sales, purchases, receipts, and payments to ensure accurate and up-to-date financial records. Bookkeeping provides the foundational data necessary for preparing financial statements, managing budgets, and making informed business decisions. It is a critical part of accounting and helps ensure compliance with financial regulations and tax laws.

CRM, or Customer Relationship Management, is a technology and strategy used by businesses to manage and analyze interactions with current and potential customers. The goal of CRM is to improve customer relationships, enhance customer satisfaction, and increase sales and retention. CRM systems typically include tools for storing customer information, tracking communication history, managing sales pipelines, marketing automation, and providing customer support. By organizing customer data in one place, businesses can better understand their customers’ needs, personalize their interactions, and build long-term relationships.

Distribution is the process of moving products or services from the manufacturer or producer to the end customers, retailers, or other outlets. It involves activities such as transportation, warehousing, inventory management, and logistics to ensure products reach the right place, at the right time, and in the right condition.

Document Storage & Receipt Management involves securely storing digital or physical documents and organizing receipts for easy access and retrieval. It helps businesses keep track of important records, manage financial transactions, and ensure compliance with regulations. Efficient management simplifies auditing, reporting, and overall record-keeping.

Expense Report Management is the process of tracking, submitting, and approving employee expenses and reimbursements. It helps organizations monitor costs, ensure compliance with company policies, and streamline the reimbursement process. Efficient expense management saves time and maintains accurate financial records.

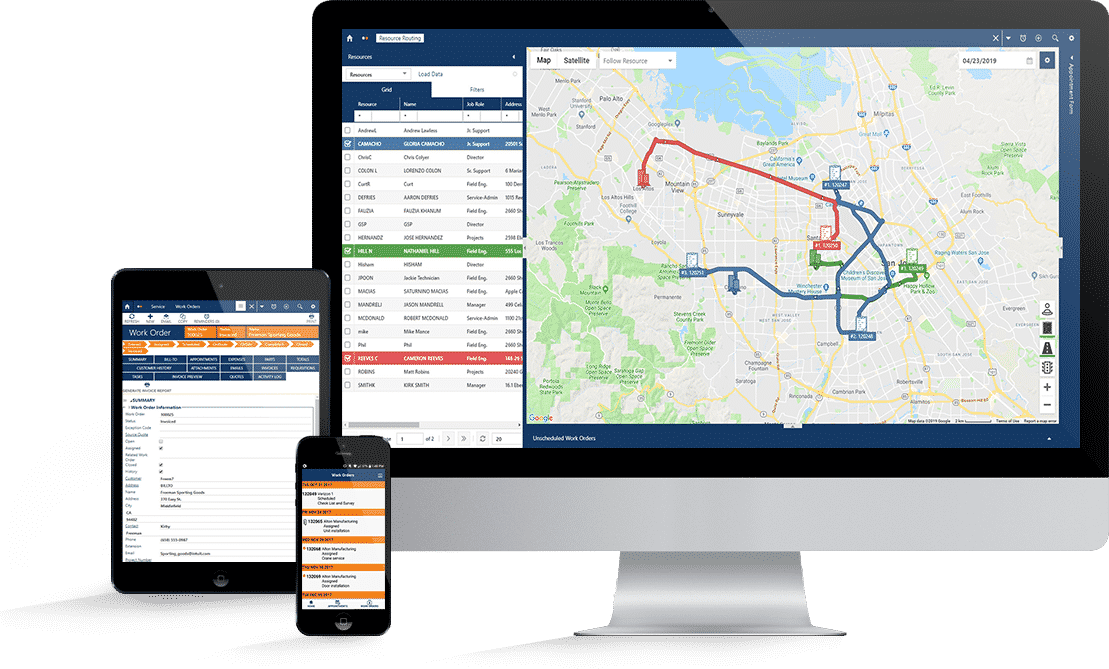

Field Service Management Solutions are tools and software that help businesses coordinate and manage work performed outside the office, such as repairs, installations, or maintenance. They assist in scheduling, dispatching, tracking technician locations, and managing work orders to improve efficiency and customer service.

Merchant Services refer to the range of financial services that enable businesses to accept payments, such as credit and debit cards, online payments, and mobile transactions. These services include payment processing, point-of-sale systems, and merchant accounts, helping businesses facilitate smooth and secure payment transactions with customers.

Payroll & Time & Billing involves managing employee wages, tracking working hours, and invoicing clients for services rendered. It ensures employees are paid accurately and on time, while also generating bills for billable hours or projects. This process helps businesses maintain financial accuracy and streamline their compensation and billing operations.

Retail Sales Solutions, also known as Point of Sale (POS) systems, are tools used by retail businesses to complete sales transactions. They include hardware like cash registers and card readers, as well as software to manage sales, inventory, and customer data. POS solutions help speed up transactions, track sales performance, and improve overall store management.

Reporting is the process of collecting, analyzing, and presenting data to provide insights into business performance. It involves creating reports that summarize financial, operational, or sales information to help managers make informed decisions and track progress toward goals.

Consulting & Sales for QuickBooks Merchant Services involve offering expert advice and assistance to businesses in selecting, setting up, and utilizing payment processing solutions. This includes helping clients integrate merchant services with QuickBooks, optimize payment workflows, and improve transaction security. The goal is to enhance the business’s ability to accept payments smoothly and efficiently.

Consulting & Sales for QuickBooks POS involve providing expert advice and support to businesses using QuickBooks Point of Sale systems. This includes helping with setup, integration, training, and optimizing the system to improve sales, inventory management, and customer service. It ensures businesses get the most out of their POS solutions for efficient operations.

Sales tax is a percentage of the sale price that is added to the cost of goods or services, collected by businesses on behalf of government authorities. It is used to fund public services and infrastructure. Consumers pay the sales tax at the time of purchase, and businesses are responsible for remitting it to the government.

Consulting & Sales for QuickBooks Payroll involve providing expert guidance and support to businesses using QuickBooks Payroll software. This includes assisting with setup, configuring payroll processes, ensuring compliance with tax regulations, and training staff. The goal is to help businesses efficiently manage employee payments, tax filings, and related payroll tasks.

Intuit Field Service Management by Corrigo is a software solution designed to help businesses efficiently manage field service operations. It streamlines scheduling, dispatching, work order management, and customer communication, enabling technicians to complete jobs more effectively. This platform improves service delivery, increases productivity, and enhances customer satisfaction by providing real-time updates and better workflow management.

Sales tax is a percentage of the sale price that is added to the cost of goods or services, collected by businesses on behalf of government authorities. It is used to fund public services and infrastructure. Consumers pay the sales tax at the time of purchase, and businesses are responsible for remitting it to the government.